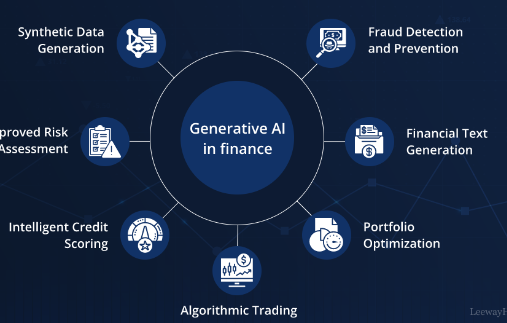

Artificial Intelligence (AI) is transforming the financial sector in unprecedented ways, making processes more efficient and decision-making smarter. As we navigate a rapidly changing world, understanding how AI impacts finance can provide better insight into both personal and global economic landscapes. This post will explore how AI is reshaping investment strategies, enhancing customer experiences, and improving risk management.

AI in Investment Strategies

AI technologies are revolutionizing investment strategies by providing tools that analyze vast amounts of data at lightning speed. Machine learning algorithms can identify market trends and patterns that human analysts might miss, allowing investors to make more informed decisions. This not only saves time but also offers the potential for higher returns. Robo-advisors, powered by AI, are particularly popular among individual investors, offering tailored portfolio management services based on risk tolerance and financial goals. With these advancements, AI is making investing more accessible and efficient for everyone.

Enhancing Customer Experience

In the finance sector, customer experience is crucial, and AI plays a significant role in enhancing it. Chatbots and virtual assistants are now common, providing instant support and personalized recommendations to customers. These AI-driven tools can handle routine queries, helping banks and financial institutions streamline their operations. Moreover, data analytics allows companies to understand customer behavior better, leading to tailored services that meet individual needs. This not only fosters customer loyalty but also builds trust, making consumers feel valued in their financial journeys.

Improving Risk Management

Risk management is a critical aspect of finance, and AI is changing the way organizations approach it. AI systems can analyze historical data and identify potential risks more accurately than traditional methods, allowing financial firms to preemptively address issues. Whether it’s detecting fraudulent transactions or assessing credit risk more effectively, AI makes it easier for companies to protect themselves and their clients. By automating the risk assessment process, organizations can respond to challenges swiftly, minimizing losses and ensuring regulatory compliance more effectively.

In conclusion, the role of AI in finance is only set to grow as technology evolves. From investment strategies to customer service and risk management, AI is making financial processes smarter and more user-friendly. If you’re interested in learning more about how AI can benefit your financial endeavors or your organization, don’t hesitate to explore more resources or reach out to financial experts in the field. Embrace the future of finance today!